If you are working to improve young people’s understanding of money, high quality resources are a great place to start. Below you will find tools and Quality Mark resources produced by us and the organisations we support that can be used by educators in formal and non-formal settings, parents/carers and children and young people themselves.

Please note: We are currently unable to ship resources outside of the UK. We are sorry for any inconvenience this might cause.

Find out more about the Quality Mark

14 – 16 Quality Mark

Your Money Matters (Wales Edition) has been designed for use with young people age 14 – 16 in Wales and covers topics including spending and saving, borrowing, debt, insurance, student finance & future planning.

14 – 16 Quality Mark

Your Money Matters (England Edition) has been designed for use with young people age 14 - 16 in England and covers topics including spending and saving, borrowing, debt, insurance, student finance & future planning.

14 – 16 Quality Mark

Your Money Matters (Scotland Edition) has been designed for use with young people age 14 - 16 in Scotland and covers topics including spending and saving, borrowing, debt, insurance, student finance & future planning.

14 – 16 Quality Mark

Your Money Matters (Northern Ireland Edition) has been designed for use with young people age 14 - 16 in Northern Ireland and covers topics including spending and saving, borrowing, debt, insurance, student finance & future planning.

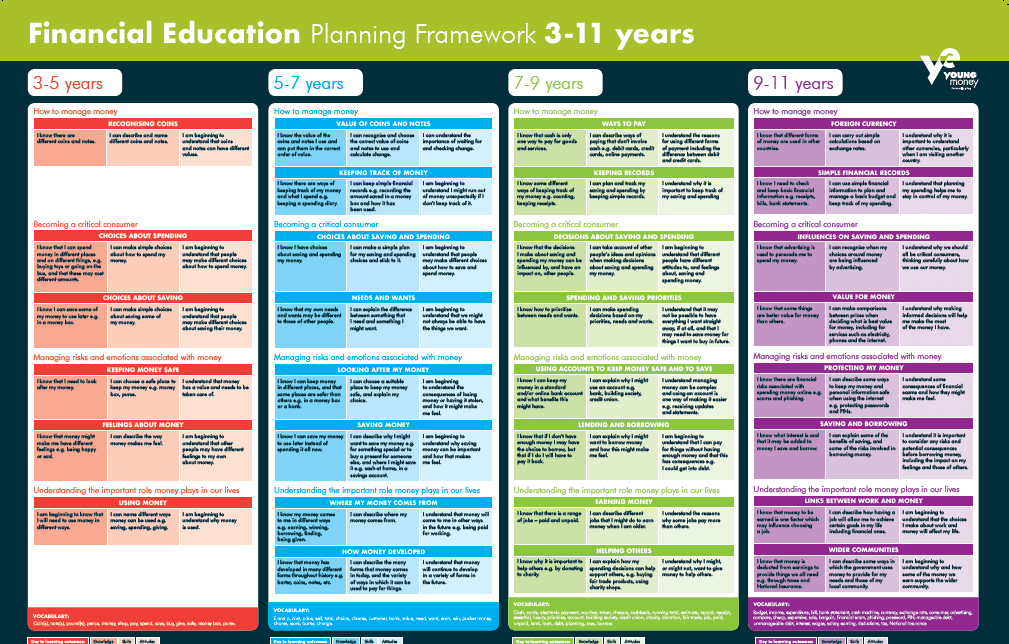

3 – 11

This framework aims to support the planning, teaching, and progression of financial education by setting out the key areas of financial knowledge, skills and attitudes, across four core themes.

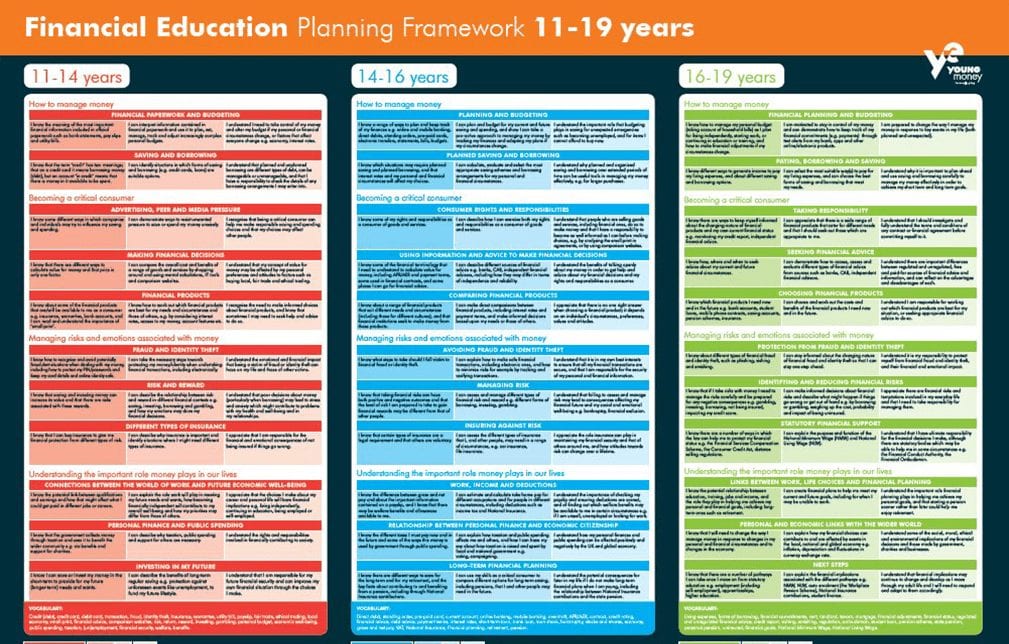

11 – 19

This framework aims to support the planning, teaching, and progression of financial education by setting out the key areas of financial knowledge, skills and attitudes, across core themes.

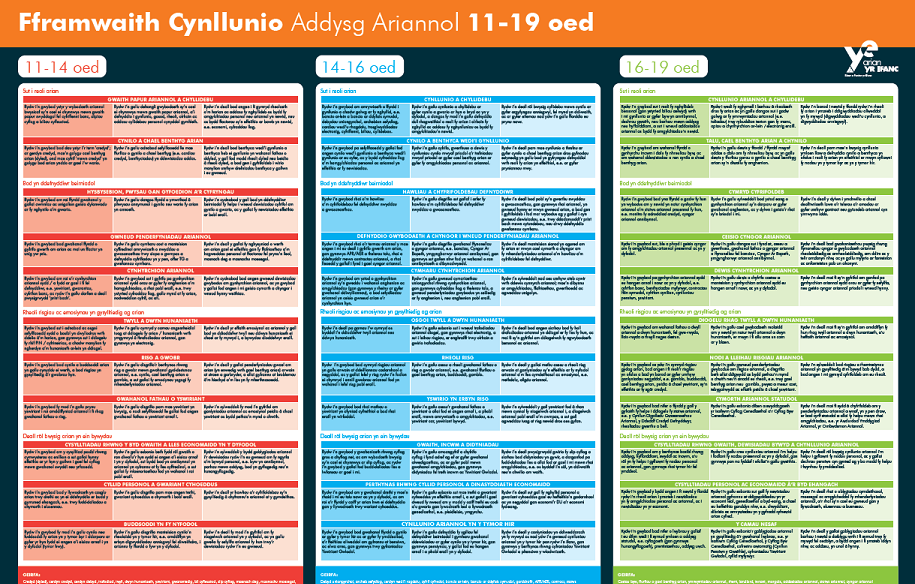

3 – 19

The Planning Frameworks aim to support the planning, teaching, and progression of financial education by setting out the key areas of financial knowledge, skills and attitudes, across core themes for ages 3 - 11 and 11 - 19.

7 – 11 Quality Mark

Family Money Twist from MyBnk teaches 7-11 year olds the basics of money whilst setting positive habits like saving and mindful spending. This independent learning course involves three interactive sessions of videos, games and quizzes supported by guidance for teachers and parents. Free and online, it is designed for direct use by children, with actionable ‘tell/ask/show’ activities to prompt important conversations. Children will gain budgeting skills and develop an understanding of delayed gratification by creating saving goals.

9 – 14 Quality Mark

Money Mapping is a resource for 9-12 year olds, developed alongside the Money and Pensions Service. Download now to access this resource in Welsh and English.